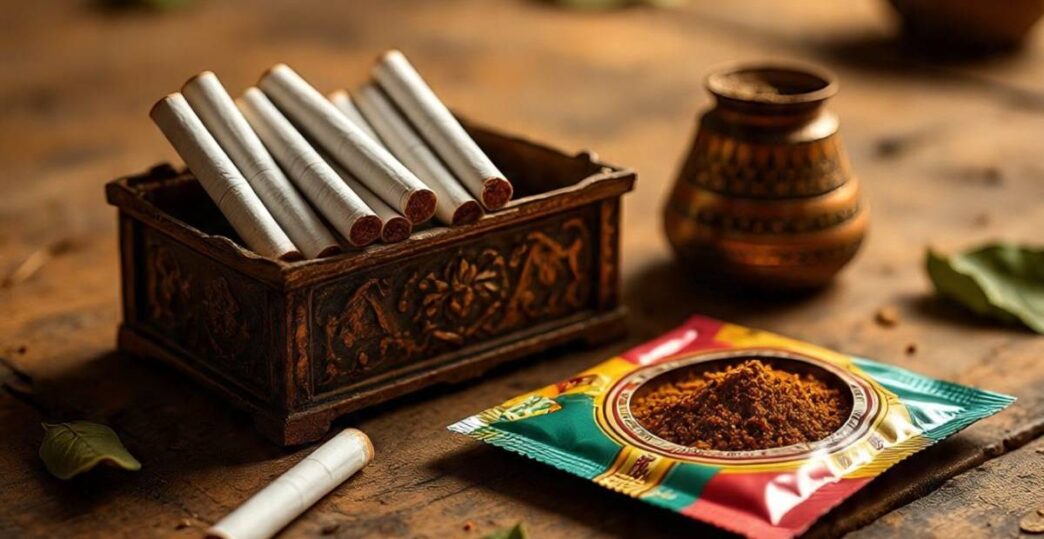

Tobacco products and pan masala are set to become more expensive across the country from February 1. The central government has announced that an additional excise duty will be imposed on tobacco products, and a new cess will be applied to pan masala. These new charges will be added on top of the existing Goods and Services Tax (GST).

This move marks an important change in the way these items are taxed. Till now, tobacco products and pan masala were already taxed under GST along with a compensation cess. From February 1, the earlier compensation cess will be removed, and the new tax structure will take its place. This means that the overall tax burden on these items is likely to increase.

Under the revised tax rules, products like cigarettes, tobacco, pan masala, and similar items will now attract GST at the rate of 40 percent. However, biris will continue to be taxed at 18 percent under GST, as before. In addition to this, pan masala will now face a new levy called the Health and National Security Cess. Tobacco and related products will also face an extra excise duty over and above GST.

The foundation for these tax changes was already prepared in December, when Parliament passed two separate Bills. One Bill cleared the way for the Health and National Security Cess on pan masala manufacturing. The other Bill allowed the government to impose additional excise duty on tobacco products. With these approvals in place, the new tax framework is now ready to be rolled out from the beginning of next month.

Government officials have stated that the revised tax system is expected to help in two main areas. First, it is likely to strengthen revenue collections for the government. Second, it aims to discourage the use of products that are considered harmful to health.